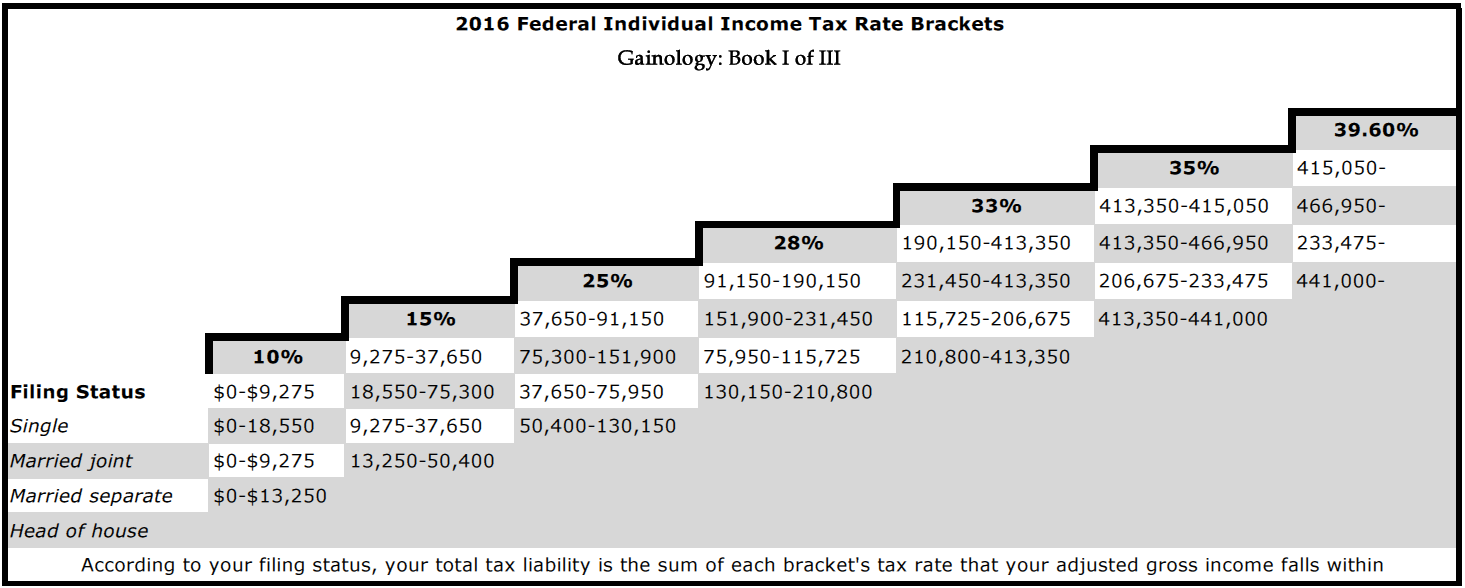

According to the 2016 income tax data released by Illinois Governor Bruce Rauner, he and his wife paid $22 million of combined state and federal income taxes on $91 million of income. Doing the math, his total tax bill amounts to having a 25% tax rate, the third lowest of the seven income tax brackets (see chart below). Another way of stating this is that they paid the tax rate as a couple who earned as little as $75,300, which is 1,208 times less money (see chart).

I’m not vilifying the Rauners for doing what each responsible tax payer should do, pay the legal minimum tax on what they earned. I’m pointing out the injustice. When the effective tax rate of the Rauners and other rich and savvy individuals is compared to those who get W-2’s, the proof is evident. The over 100-year-old income tax code is not now and has never been a satisfactory means of leveling the playing field and redistributing wealth. It is unequal and unfair in just about every manner possible. In fact it, along with other governmental financial regulations, often tends to cement the status quo, helping the rich get richer and the poor poorer. For these reasons and others, an overhaul of the tax and financial institution regulation is overdue. This means, in a sense, that I agree with Republicans, Independents and Libertarians.

To create an environment where more people are able to gain economic momentum and not just a 1% minority of society, the 77,000 pages of income tax code need to be reformed, simplified, overhauled and whatever verb you think of which describes complete evisceration. As Jesus put it, you don’t put new wine into old wineskins, unless they burst, and all is lost.

This is coming from a CPA with nearly 25 years of experience with helping people legally lower their income tax expense.

The tax code must be overhauled, just not in the manner that Republicans are proposing now. Nor does it need to be tweaked in a way that Democrats would prefer; both are tantamount to more of the same. For instance the Tax Cut and Jobs Act is more of the same, multiple loopholes with:

- Tax brackets

- Filing statuses

- Income Classes

- Deductions

- Credits

- Exemptions

- Expenses

It is time for a change, not to repeat the same mistakes. What’s needed is a flat income tax without loopholes, tax deductions or exemptions and only one credit. That one credit is equal to the taxes that have been paid. That would be true top-to-bottom, tax overhaul. Corporations could reduce their tax rate to zero by distributing 90% of their profits to their owners. Zero percent is the carrot; the stick is a 100% tax of their profit if they don’t distribute the profits to owners. I talk about this in my latest Gainology book and in the original Mo’Sense version that was published in 2005. By the way, such a tax rate structure already exists. REIT’s (real estate investment trusts) avoid federal taxation by paying 90% of their profits to their owners.

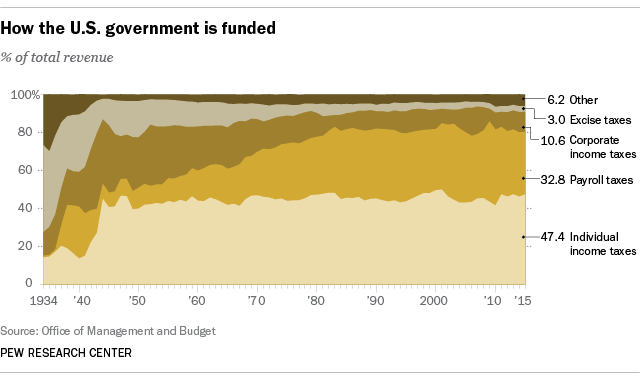

This flat tax could be enacted before Christmas with bipartisan support. It would decrease the deficit and immediately spur economic growth just as the one time $169 billion special dividend from Microsoft did in December 2004. It would because individuals pay over 65% (see graph below) of the total tax collected by the federal government while corporations pay a paltry 10.6% of taxes, a rate that has decreased since the 1950’s. A flat income tax with a conditional zero percent tax rate for corporations that distributed 90% of their income to the owners wouldn’t be just a theoretical tax savings and jobs gained projection. This would be real.

Each business/shareowner would be able pursue life, liberty and happiness with some of the greater than $2 trillion that publicly-traded businesses are hoarding in bank accounts and short- term investments. It makes fiscal, economic and momentum sense to pass laws that put more money in the hands of individuals because we, not artificial beings, actually pay the majority of the government’s bills.

In the end a flat tax is the closest we can get to having a like-new, overhauled tax code in the United States because with over $19 trillion of federal debt alone, repealing the 16th Amendment (which made it legal to directly tax individual incomes) is unlikely. All men being treated equally is an American ideal. It isn’t supposed to be about continuing to treat some people who can afford to jump through tax loopholes like men and others who can’t like 3/5’s of a person as the Tax Cut and Jobs Act does for individuals with a huge corporate 43% tax reduction giveaway.

Mr. Eric O. January is CPA, author of the Gainology Book Series, consultant and business owner. His Gainology book series was formerly titled Mo’Sense. Eric is foremost a problem solver. He has been focused on helping clients get the most from their money and business interests for over a quarter of a century. For further information and to contact him, visit the websites, www.conduitfunding.com and www.EinsteinofFinance.com, call (877) CONDUIT (266-3848), or email ericjanuary@conduitfunding.com