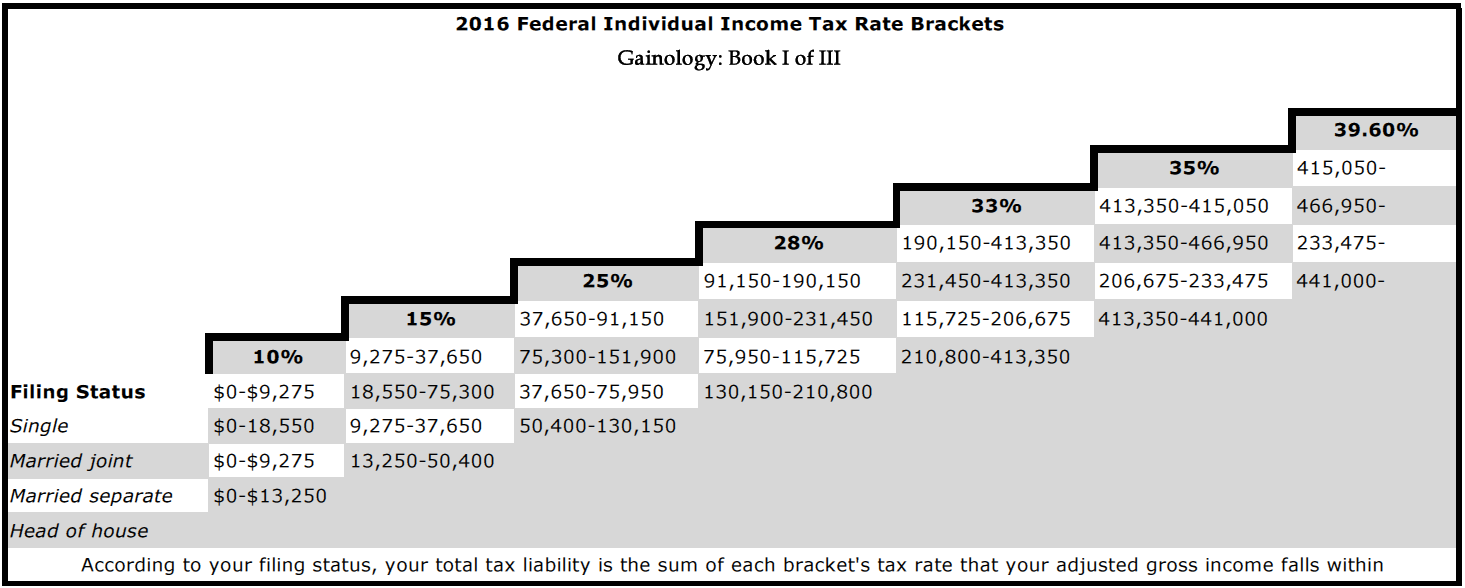

According to the 2016 income tax data released by Illinois Governor Bruce Rauner, he and his wife paid $22 million of combined state and federal income taxes on $91 million of income. Doing the math, his total tax bill amounts to having a 25% tax rate, the third lowest of the seven income tax brackets (see chart below). Another way of stating this is that they paid the tax rate as a couple who earned as little as $75,300, which is 1,208 times less money (see chart).